We would be honored to serve you

We specialize in Large Loss Insurance Claims. We are licensed professionals in estimating, preparing and negotiating large loss property damage claims.

What is A Public Adjuster?

Property insurance policies obligate the policyholder to prove a claim to the insurance company. Public adjusters are skilled in all aspects of the claims process and understand complex insurance policies from an adjuster’s point of view, putting the insured on equal footing with their insurance carrier. Public adjusters are also trained to identify covered damage and estimate appropriate repair or replacement costs. Additionally, they are familiar with the Insurance Industry and its customs and practices. As a result, they are able to present claims in such a way as to assure the most favorable outcome for the Insured.

Knowing that a public insurance adjuster is carefully documenting the damage, and working on your behalf to ensure that you get everything you deserve, brings peace of mind during a stressful time.

Disaster Assistance

Aviation Information

Federal Aviation Administration

Support Information

American Red Cross

A humanitarian organization that provides emergency assistance, disaster relief.

Texas Windstorm Insurance Association

To Report a Claim or Check on the Status of a Claim Call 877-281-1431 (English) or 866-443-3144 (Spanish), Available 24/7

Visit the Claims Center Email: claims@twia.org

To Discuss Non-Claims Issues Call 800-788-8247, Available 24/7

For Agent Support Visit the Agent Portal Email: agentservices@twia.org

For Policy / Underwriting Support – Residential Call 1-800-788-8247,

Option 3 Email: agentservices@twia.org

For Policy / Underwriting Support – Commercial / Manufactured Home Call 1-800-788-8247, Option 4 Email: commuwteam@twia.org

Our adjusters use the following methods and forms to document your property damage in order to build the strongest and most compelling claim for your insurance provider:

Methods

Sequencing photos, taking samples, applying previous knowledge to your situation.

Forms

Digital photos, RoofCAD, Pictometry, video, and extensive notes for documentation

Methodical In-Depth Documentation

Partnering with You as Your Public Adjuster!

D.A. LAMONT PUBLIC ADJUSTERS’ mission is to achieve the highest standards in being the most professional and successful, as well as efficient in any claim settlement while serving the best interests of the policyholder. We stand to exceed expectations while priding ourselves in ethics, respect, loyalty, integrity, and professionalism.

Why hire a public adjuster?

Public Adjusters exist because of the inherent conflict of interest when one entity or person represents two sides of a financial transaction.

Knowing that a public insurance adjuster is carefully documenting the damage, and working on your behalf to ensure that you get everything you deserve, brings peace of mind during a stressful time.

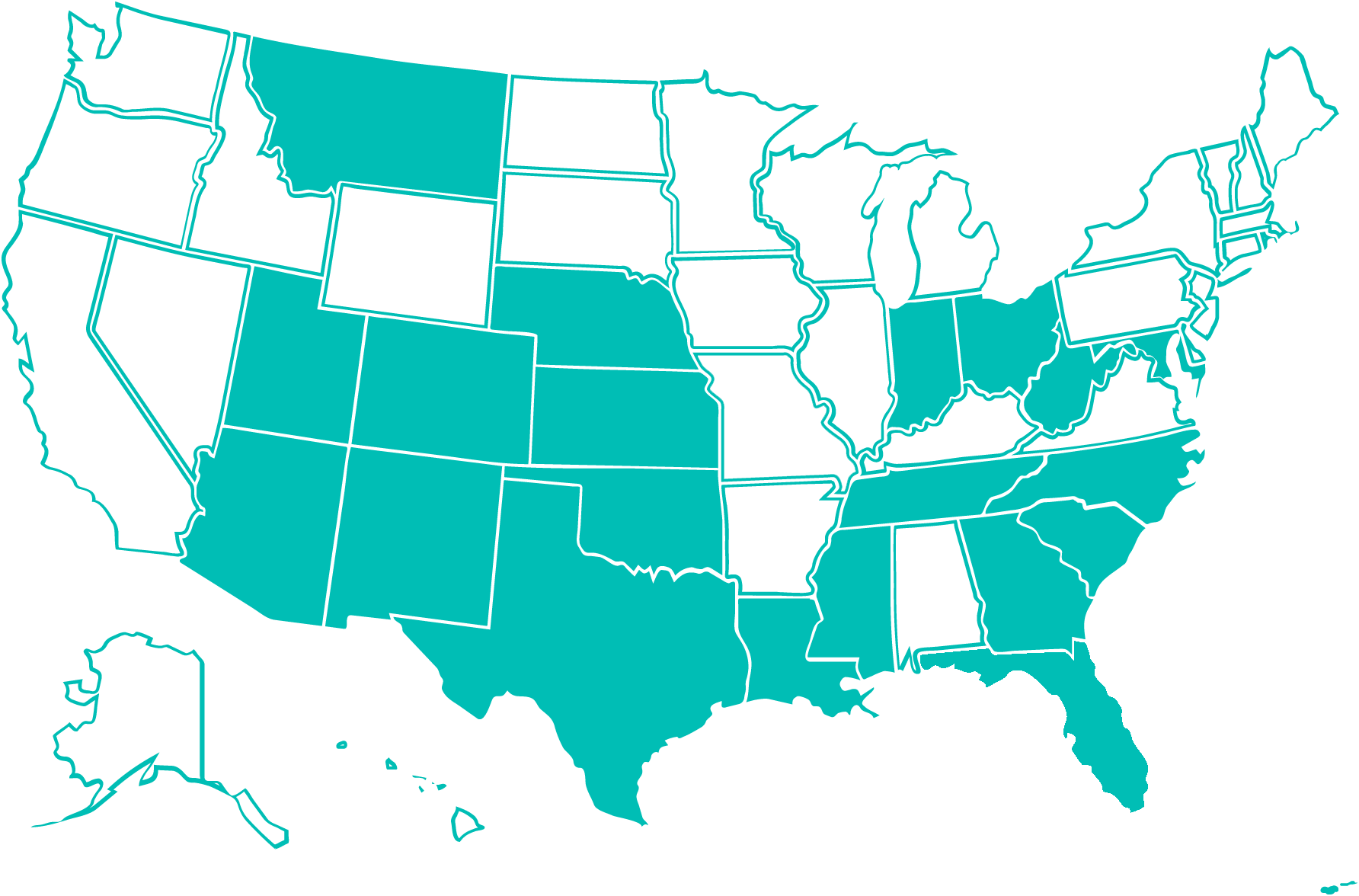

Licensed Service Areas

Property Insurance policies obligate the policyholder to provide a claim to the insurance company. D. A. Lamont Public Adjusters are trained to identify covered damage and estimate appropriate repair or replacement costs. Additionally, they are familiar with the insurance industry and its customs and practices. We are able to present claims in such a way as to assure the most favorable outcome for the insured.

Public Adjusters Representation Typically Results in Larger Payments to Policyholders

Source: OPPAGA analysis. Data refers to the median (50th percentile or typical) payment.